south dakota sales tax rates by city

The South Dakota State South Dakota sales tax is 450 consisting of 450 South Dakota state sales tax and 000 South Dakota State local sales taxesThe local sales tax consists of. Of the sales tax return.

2022 Property Taxes By State Report Propertyshark

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

. IN ADDITION TO MUNICIPAL SALES TAX City July 2022 Rate General Code July 2022 Rate Tax Code Lodging Eating Establishments Alcohol Admissions Corsica 200 082-2 100 1 X. The South Dakota SD state sales tax rate is currently 45. Local tax rates in South Dakota.

The Rapid City Sales Tax is collected by the merchant on. The average local rate is 19. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Average Sales Tax With Local. What is the sales tax rate in Junction City South Dakota. Searching for a sales tax rates based on zip codes alone will not work.

The minimum combined 2022 sales tax rate for Mound City South Dakota is. All businesses licensed in South Dakota are also required to collect and remit municipal sales. The South Dakota sales tax rate is currently 45.

Other taxes include telecommunications taxes tourism taxes and motor vehicle taxes. Enter a street address and zip code or street address and city name into the provided spaces. The Sturgis South Dakota sales tax is 650 consisting of 450 South Dakota state sales tax and 200 Sturgis local sales taxesThe local sales tax consists of a 200 city sales tax.

14 rows The base state sales tax rate in South Dakota is 45. Combined with the state sales tax the highest sales tax rate in South Dakota is 75 in the city of Roslyn. What is South Dakotas Sales Tax Rate.

Depending on local municipalities the total tax rate can be as high as 65. Municipalities may impose a general municipal sales tax rate of up to 2. The state sales and use tax rate is 45.

Sturgis collects a 2 local sales tax the maximum local sales tax allowed under South Dakota law. The average combined tax rate is 64 ranking 31st in the US. There are a total of 289 local tax jurisdictions across the state collecting an average local tax of 1814.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. 400 Is this data incorrect The Rapid City South Dakota sales tax is 400 the same as the South Dakota state sales tax. Sales tax rates in South Dakota are destination-based meaning the sales tax rate is determined from the shipping address.

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. 31 rows City Total Sales Tax Rate. This includes South Dakotas state sales tax rate of 4000 and Rapid Citys sales tax rate.

While many other states allow counties and other localities to collect a local option sales tax South Dakota does not permit local sales taxes to be collected. The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes admissions taxes and taxes on eating establishments. For additional information on sales tax please refer to our Sales Tax Guide PDF.

Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. North Dakota has a 5 sales tax and Williams County collects an additional 1 so the minimum sales tax rate in Williams County is. In South Dakota each county city and special district can add sales taxes on top of the state rate.

Aberdeen SD Sales Tax Rate. The Mound City sales tax rate is. 450 Is this data incorrect Download all South Dakota sales tax rates by zip code.

Local taxes apply to both intra-state and inter-state transactions. This is the total of state county and city sales tax rates. The South Dakota Department of Revenue administers these taxes.

The South Dakota sales tax rate is currently. The South Dakota SD state sales tax rate is currently 45 ranking 36th-highest in the US. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

What Rates may Municipalities Impose. Belle Fourche SD. The minimum combined 2022 sales tax rate for Junction City South Dakota is.

The South Dakota sales tax and use tax rates are 45. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. The South Dakota State Sales Tax is collected by the merchant on all.

Depending on local municipalities the total tax rate can be as high as 65. The County sales tax rate is. 366 rows South Dakota Sales Tax.

This is the total of state county and city sales tax rates. Click Search for Tax Rate. The Sturgis Sales Tax is collected by the merchant on all qualifying sales made within Sturgis.

Depending on local municipalities the total tax rate can be as high as 65. The total sales tax rate in any given location can be broken down into state county city and special district rates. For cities that have multiple zip codes you must enter or select the correct zip code for the address you are supplying.

The following South Dakota cities are located within Special Jurisdictions. South Dakotas sales and use tax rate is 45 percent. Services received or products delivered within.

The South Dakota SD state sales tax rate is currently 45. If you need access to a database of all South Dakota local sales tax rates visit the.

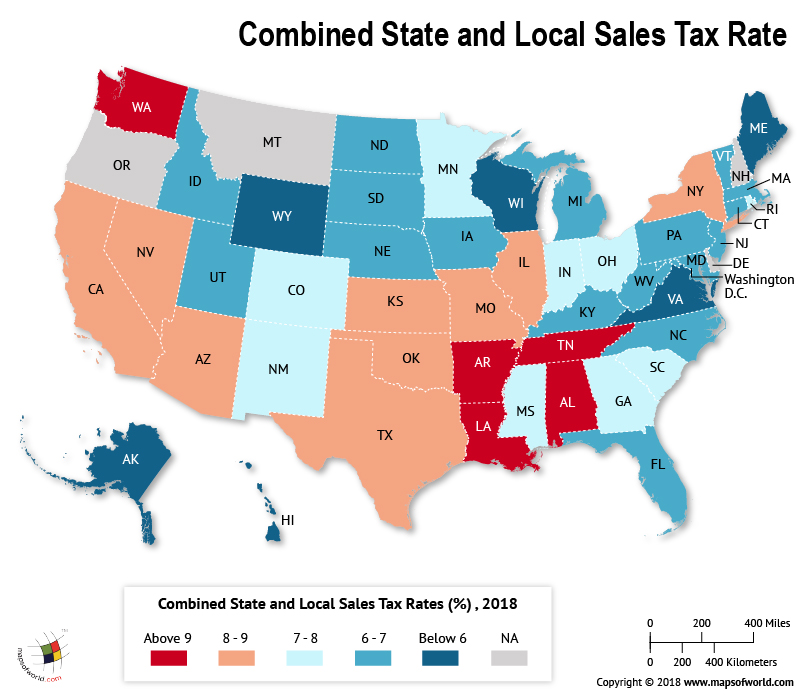

States With Highest And Lowest Sales Tax Rates

The States With The Highest Capital Gains Tax Rates The Motley Fool

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Most And Least Tax Friendly Us States

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Tax Rates By State Where To Start A Business

Sales Taxes In The United States Wikiwand

South Dakota Sales Tax Rates By City County 2022

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax By State Is Saas Taxable Taxjar

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

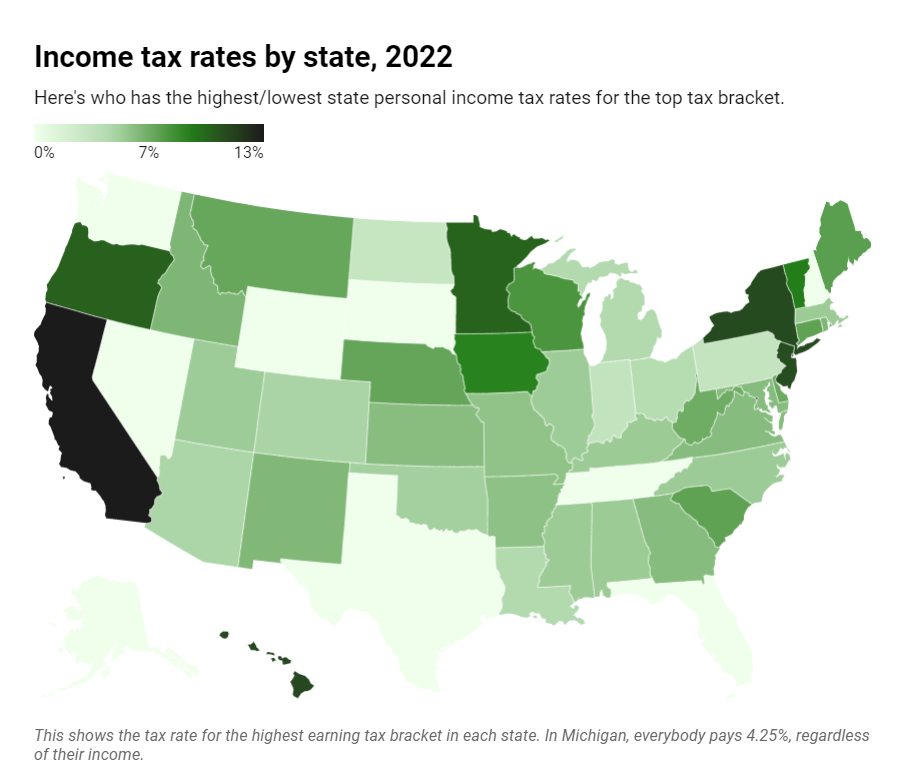

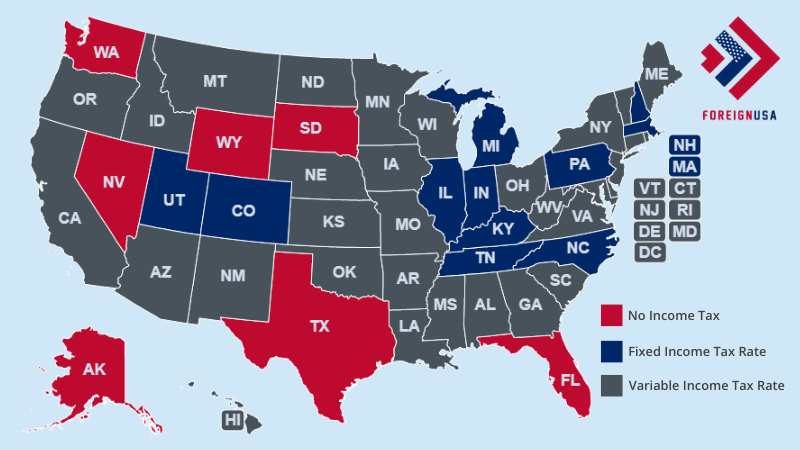

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation